The Simple Concept That Turns Employee-Owners into Millionaires

Employee ownership is a unique way of building wealth that allows employees to become company owners by owning shares of company stock. Compound interest plays a crucial role in this process as it helps to accelerate the growth of employee owners’ wealth over time. Allowing enough time for compound interest to work is essential for building wealth through employee ownership.

Company performance also has a direct impact on the growth rate of an employee owners’ wealth. Even small improvements in the company’s performance can have a significant compounding effect on an employee-owners’ wealth.

Compound interest is when invested money earns interest on both the original amount as well as the interest already earned. For example, if you invest $2,000 at an interest rate of 10% annually, you will earn $200 in the first year making your total $2,200. In the second year, you earn interest on the full $2,200, which comes out to $220. This includes $200 of growth from the initial $2,000 plus $20 from the $200 of growth from the first year. That $20, the growth made solely from prior growth, is compound interest. Compound interest means your money is growing at an accelerating rate.

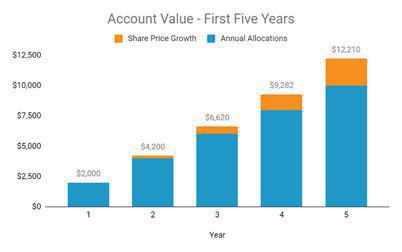

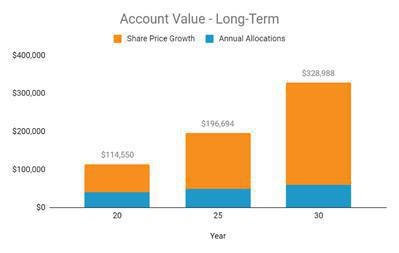

Employee-owners tap into compound interest by owning shares of company stock. The stock has a value determined by the company’s share price, which fluctuates based on the value of the business. Typically, employee-owners are given an annual allocation of company stock that is paid for with company profits, providing an extra boost to account growth in the initial years when compound interest is still gaining momentum.

An employee owner’s account value grows significantly with time, driven primarily by compound interest and share price growth. Allocations make up the bulk of the account value early on but become less important as compound interest ramps up. After 5 years, allocations account for over 80% of the account value, but after 30 years, share price growth accounts for over 80% of the account value.

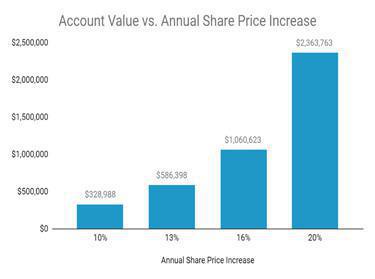

The success of the company is the next most important factor in building wealth. In general, the more successful a company is, the faster its share price will grow. The average rate of return based on public stock markets is 10%. It’s possible for a successful private company to outperform this baseline. A 1% annual increase in the company share price can lead to changes in final account values of $100,000 to $200,000.

If an employee receives $2,000 of annual allocations and the company can achieve a 20% rate of return over 30 years, that could result in the employee-owner retiring with over $2 million. While not all companies can achieve this, it’s not without precedent. WinCo Foods, for example, grew at this rate from 1986 to 2014.

No company’s share price is guaranteed to increase, and bankruptcy could result in the shares being worth nothing. However, for employee owners, this risk is offset by the fact that shares are paid for out of company profits, with the employee-owners not putting in any of their own money. And of course, no financial gain comes without risk